Section 189 and 189a of the Labour Relations Act (LRA) allow employers to dismiss employees based on operational requirements. It is the employer’s responsibility to prove that a genuine operational requirement exists. This requires identifying warning signs or red flags of distress and having a forum to meet regularly with management to identify, understand and solve problems upfront.

Operational requirements

means requirements based on the economic, technological, structural or similar needs of an employer. (LRA)

Trade unions have the power to push employers to take the necessary steps to stimulate the economy to create jobs and prevent retrenchments. Unions also have the power to adopt practical strategies to save jobs, including intervening before retrenchment proceedings are formally launched.

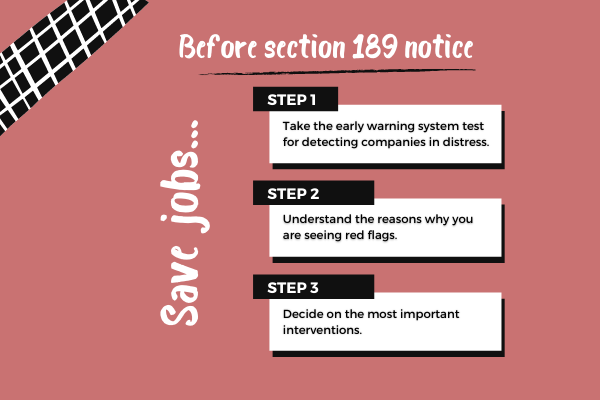

Steps to take before section 189 is issued

Instead of simply trying to save jobs at the last minute through a retrenchment process, it is better to try to tackle problems in companies before retrenchment is announced.

A first step in preventing retrenchments is to use the following red flags as an early warning system of distress at the company. If you answer “YES” to some of these red flags, or if you notice that more of these red flags start occurring over time, there is good reason to be concerned that job losses might happen.

Step 1: Take the early warning system test for detecting companies in distress

Try to answer these questions about the company:

- Have orders in the company reduced in recent months?

- Are machines standing idle (not being used) for long periods of time in the company?

- Has the company lost a big client or a few clients recently?

- Have customers been buying more imports and/or cheaper imports instead of your products?

- Have working hours been reduced (less overtime/more short-time/layoffs/rotation)?

- Has your company been experiencing late or slow deliveries?

- Have workers been moved around in various departments because there is not enough work?

- Has management been complaining recently that the company is losing money?

- Has the company been trying to change anything to save costs?

- Has the company stopped repairing equipment, machinery, the building, toilets, etc. in order to save money?

- Has the company been experiencing lots of resignations from management and staff?

- Has the company asked workers to take early retirement?

- Has the company put a freeze on hiring?

- Has the company stopped paying bonuses or stopped any incentives?

- Has the company been complaining about rising costs?

- Have you been worried about the future of the company or workers’ jobs?

- Has the sector been experiencing hardship/ distress/job losses for a few years?

- Have you experienced any short payments or lack of payments of wages?

- Is the company late with its bargaining council levies, UIF payments, or other statutory payments?

- Has the company stopped its non-essential functions e.g. not buying supplies like stationery, toilet paper, tea and coffee?

- Have you heard rumours that the company may restructure or retrench?

Even if you answer “Yes” to only a few of these red flags, the company may be in distress and it may be necessary to intervene.

Now that you have taken the first step and scanned the company for red flags, it is important to continue your research before jumping to any conclusions.

Step 2: Understanding the reasons why you are seeing red flags

Businesses can experience challenges for many reasons. It is important that we are able to identify some of the factors underlying the problems they face. In general, these problems can be caused by internal challenges within the company or external challenges due to other economic reasons, or a combination of the two.

Management often believe they know the cause of their problems, but they can be wrong. Trade unions can bring knowledge of the business from the ground up.

Which of these factors apply to the company that you are concerned about?

Internal factors causing company distress:

- Poor management

- Ineffective Board of Directors

- Uncompetitive product or services

- Inadequate financial control

- High-cost structure

- Outdated technology

- Lack of marketing or sales capabilities

- Excessive diversification – not enough focus

- Poor data management and ICT systems

- Poor decision-making regarding spending

- Inappropriate financial policies

- Overtrading

- Short-term thinking

External factors causing company distress

- Poor economy

- Changes in market demand

- Availability of finance

- Technological change

- Government policy

- Competition

- Commodity prices

- Social change

- Environmental factors

- Exchange rates

- Industry factors

Step 3: Decide on the most important interventions

It is difficult to try to solve lots of problems at once as this reduces your chances of success. It is better to focus and identify one or two of the most important problems to solve, which would help save jobs and try to solve those first. Afterwards, you can move on to other problems.

It is better to focus and identify one or two of the most important problems to solve, which would help save jobs.

Example: You reliably know that a company faces challenges around outdated technology, availability of finance, government policy and exchange rates. It is a great task to try to understand and solve all of these challenges at the same time.

- You could focus on government policy if the union can influence policy.

- Or, you could focus instead on the challenge of available finance, understand what the need for finance is and explore the company’s options.

- You may be able to link financing to addressing the challenge of outdated technology, but this will depend on the situation.

- If exchange rates are key to the company’s success, then you might focus on this rather. Influencing the exchange rate is not a viable strategy, so the union might rather explore possibilities for limiting the financial risk of unfavourable exchange rates.

You might like:

How unions can support workers facing retrenchment

Takeaway: Negotiatiating retrenchments – A trade union guide to saving jobs (PDF)