This information is for wage negotiators in all kinds of bargaining environments, from the formal to the more informal. You will learn:

- How to build an argument

- How to build a wage

- The different approaches to dealing with inflation

- Simple formulas for calculating percentages and money amounts

Building my argument

A wage demand is more persuasive if it can be shown the demand is reasonable in some way.The most common way to build an argument is to compare the current wage to other benchmarks that show that the wage should be higher. If the wages for similar jobs at other companies in the same sector are higher than the wages at your company, then that is one motivation for your demand.

The information required to prepare for wage bargaining and where to find it

The kind of information that a negotiator needs for wage bargaining is not always freely available. We must consider producing our own information.

The negotiator can get information from workers, workers in other parts of the company and workers at other companies.

The ability to search the Internet for some of the information that we need for wage bargaining is increasingly important. Here are some examples of sources:

Wage settlement trends on this website:- The Actual Wage Rates Database (AWARD) is a repository of collective agreements that tracks minimum wages, providing unions with empirical evidence to inform collective bargaining.

- Agreements database (AGREED) is a repository of collective agreements suitable for research and education.

- The South African Multinational Company (MNC) database contains the financial information for over 80 JSE-listed companies, including executive pay.

- The Quarterly Labour Force Survey (QLFS) is published by Statistics South Africa.

- Commentary on particular companies in print and online newspapers

- Labour market statistics in different industries is published on several online resources, for example, Statistics South Africa.

Wage levels – get information from workers and from the company, and on this website.

Company information at CIPC register of companies, LRS MNC database, in online annual reports of companies listed on the stock exchange, or on request.

Workers’ expectations – get information from workers.

Building my wage demand – a checklist

- What wage levels am I dealing with, and for which occupations?

- Is my focus on percentages or rands-and-cents?

- Do we want an across-the-board increase or a staggered increase?

- What is happening with inflation, and what does this mean for wage negotiations?

- How is the industry performing?

- How is the company performing?

- Are there any factors currently at play in the company or industry that might influence negotiations?

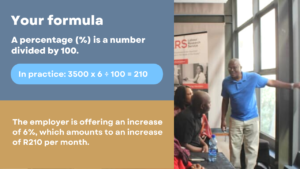

Brush up on your understanding of percentages

When you are considering a percentage increase, think about the following:

- How does that percentage translate into Rands-and-cents, and what does that Rands-and-cents amount mean to workers?

- How would inflation affect the increase?

An example: Workers are earning R3500 per month as a basic wage. Employers are offering a 6% increase. Inflation is 3.5%.

Understanding inflation

The latest inflation number tells you what has happened to prices over the last 12 months. The source of inflation information is Statistics South Africa. The consumer price index, which measures the increase in prices (of a basket of goods and services) over time, is published monthly, with a lag of 1 to 2 months.

You can find the original publication on the website of Statistics South Africa. Search for the publication number (P0211). Or find issues of our Inflation Monitor publication (a simplified version of monthly inflation) here.

Inflation and wages

Inflation should not dominate wage negotiations, but it is an important consideration. Inflation tells you about the buying power of a worker. If a worker gets a 5% increase and inflation is at 5%, then the buying power of the worker stays the same. If a worker does not get an increase for a time, then the buying power of their wage will decrease because prices tend to increase over time.

What is a real wage and real increase?

An example:

The current wage is R4000 per month in January 2020. The wage increase on the table is 6%. The latest inflation rate available is CPI 4.5% in January 2020 (This describes the increase in prices between January 2019 and January 2020).

If inflation stays at 4.5% in the months to come, then that is the increase that is needed just to protect the value of the wage. Anything less than 4.5%, and workers will become poorer.

In this example, we hope that the increase in workers’ wages in the previous year was greater than 4.5%, otherwise, they have less buying power than they had before.

The increase of 6% is greater than the estimated inflation rate by 1,5%. The real wage increase is 1,5%. In theory, this worker should have 1,5% more buying power than they did before.

In practice, this will depend on what they spend their money on and what the inflation rates are for the items that take up most of their spending.

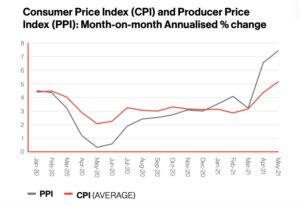

The inflation numbers that we have now hold clues about what inflation will be in the next period. Look at the trend in inflation over the last 12 months to see if it has been rising, falling, or up and down. You can also look back at past settlements and compare them to inflation to see what gains and losses workers have made in the past.

The Producer Price Index (PPI), also published by Statistics South Africa, can help you predict what inflation might do going forward. If PPI has been rising for the last 3 months, then that increase might begin to show in consumer prices (CPI) within the next few months. The graph below shows the monthly CPI and PPI between Jan 2020 and May 2021.

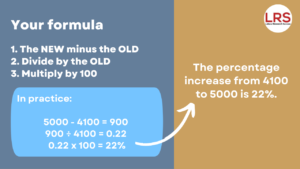

Calculate the percentage increase from one wage level to another wage level

An example:

The wage now is 4100 per month and we want to shift this to 5000 per month. What is the percentage increase from 4100 to 5000?

You can use a calculator if you choose (try the LRS wage calculator). In our example, the new wage is 5000, and the old wage is 4100.

The full calculation would be: (5000 – 4100) ÷ 4100 x 100 = 22%

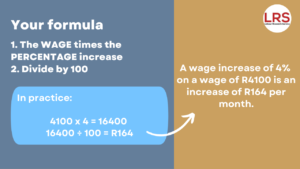

How to convert a percentage increase into Rands-and-cents

An example:

I am working with a monthly wage of 4100 and exploring a 4% wage increase. What is this percentage increase in Rands and cents?

In our example, the wage is 4100 and the percentage increase is 4%.

The full calculation would be: 4100 x 4 ÷ 100 = R164

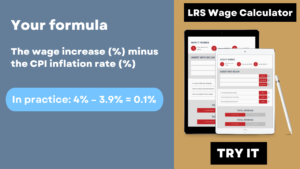

A formula for understanding the real increase after inflation

An example:

The wage is R4000. The percentage increase on the table is 4%. CPI inflation is 3.9%. How do I deal with this in negotiation?

Following the formula, the increase that is left after inflation is 0.1%. In other words, after the increase in the prices of the things we usually buy, this is the real increase.

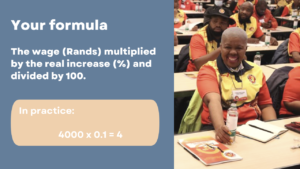

What is the money value that is left of this increase after accounting for price increases?

If prices increased by 3.9% immediately following the above wage increase, it is important to calculate how much extra the worker will have after buying the things which they usually buy each month.

Following the formula, the real increase in the wage per month after inflation is R4. This means that the buying power of the wage is practically unchanged after the increase and that workers would need an additional increase to improve their buying power. If the increase left after inflation is very small or negative, then one must look at adding an improvement factor to the increase.

Checklist for dealing with inflation in wage increases

- What is the wage increase percentage that is on the table?

- What is the latest rate of inflation?

- What is the trend in inflation over the last 6 months or more? What does it tell us about the likely inflation rate over the next 12 months?

- Are there any other reasons why inflation might increase or decrease significantly in the coming months?

- Is the wage increase greater than inflation? How much of the increase is left after inflation?

- How much do we want the buying power of the wage to increase by?

11 steps you should take to prepare for wage bargaining

Takeaway: An introduction to wage bargaining – a guide for trade union negotiators (PDF).