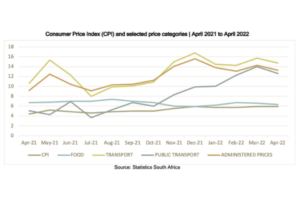

The Consumer Price Index came out unchanged at 5% compared to September. Food and transport costs are the biggest contributors to the rate, with the transport index increasing by 10.9% in October 2021 compared with October 2020. And the SARB has raised its main lending rate by 25 basis points to 3.75%, meaning the prime lending rate of commercial banks will increase to 7.25%.